How it works

A platform built for aerospace

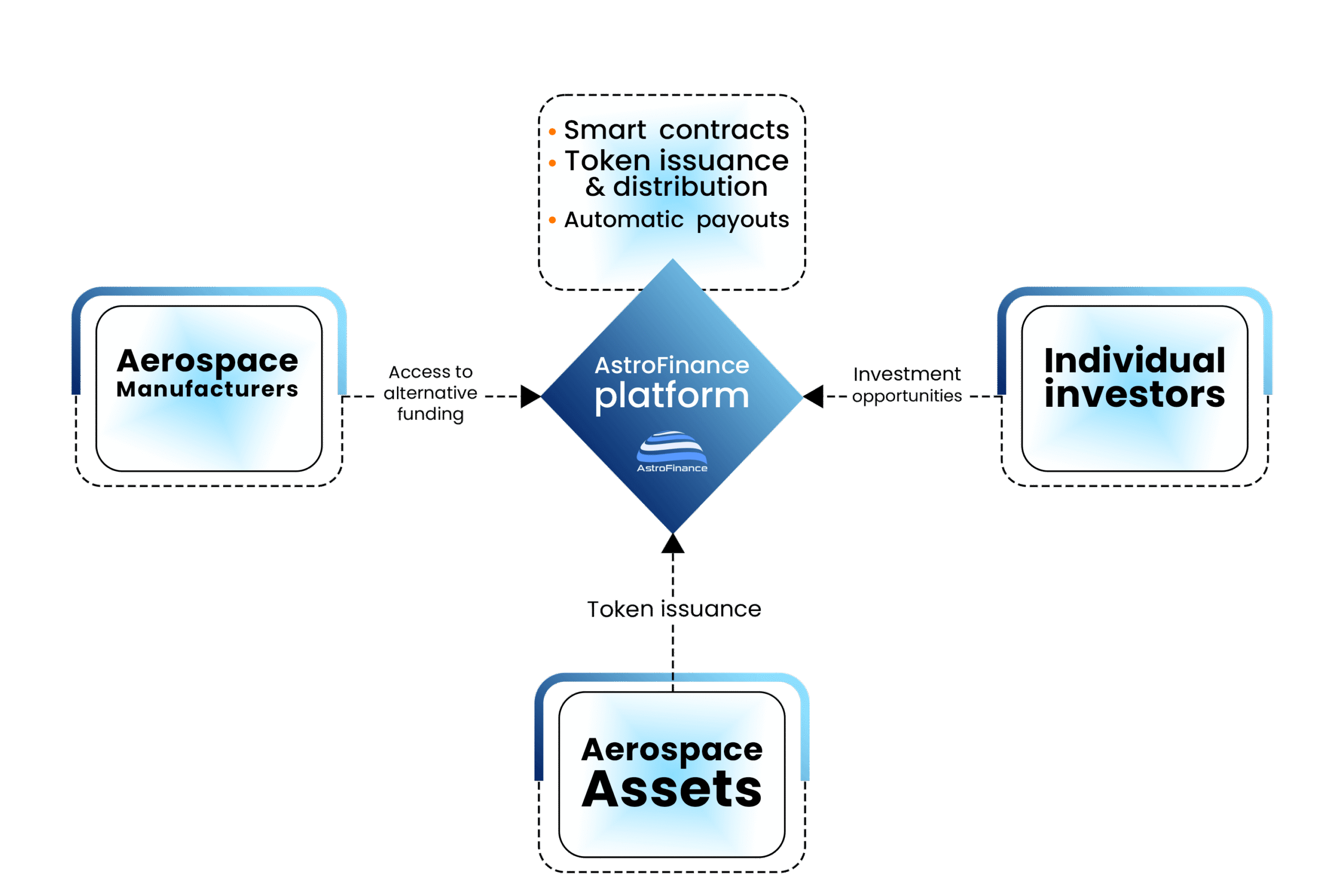

AstroFinance is a platform that provides asset manufacturers and operators with faster, more efficient access to capital. It enables individual investors to purchase fractional shares in high-value aerospace assets. Aerospace assets and associated revenue streams are converted to secure digital tokens, and smart contracts distribute profits securely, transparently, and automatically.

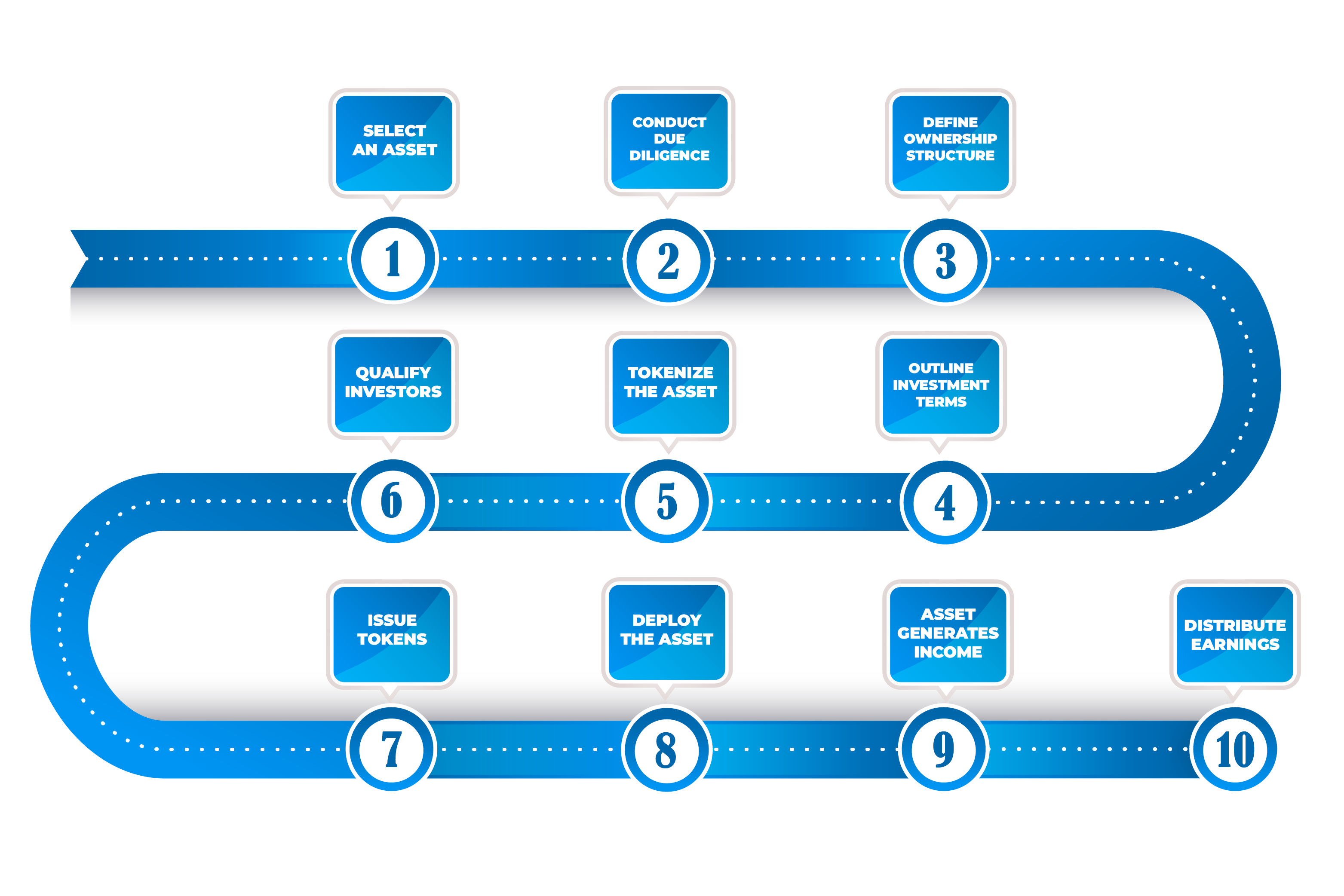

How It Works: From Asset to Earnings

AstroFinance turns real aerospace assets into investment opportunities in 10 steps — combining blockchain security with aerospace expertise to ensure trust, efficiency, and returns.

- Select an Asset – AstroFinance scouts for a revenue-generating aerospace asset.

- Conduct Due Diligence – AstroFinance assesses technical, financial, and operational viability.

- Define Ownership Structure – An SPV is created to hold the asset and manage legal compliance.

- Outline Investment Terms – The revenue model, investor rights, and payout terms are defined.

- Tokenize the Asset – The asset is split into digital tokens representing revenue rights.

- Qualify Investors – Investors are onboarded and verified via a rigorous compliance process.

- Issue Tokens – Tokens are issued for purchase on the AstroFinance platform.

- Deploy the Asset – The asset is manufactured or acquired and handed over to the operator.

- Asset Generates Income – The asset starts producing revenue through its intended use.

- Distribute Earnings – A portion of revenues generated are shared with investors via smart contracts.